[column width=”1/1″ last=”true” title=”” title_type=”single” animation=”none” implicit=”true”]

IRS Federal Tax Lien, What do you do when you get an IRS TAX LIEN?

What is a Federal tax lien?

A Federal tax lien may be filed by the IRS when a taxpayer owes $10,000 or more in unpaid tax debt. It is not a levy nor garnishment which are “collection methods” for the IRS to collect on a tax obligation.

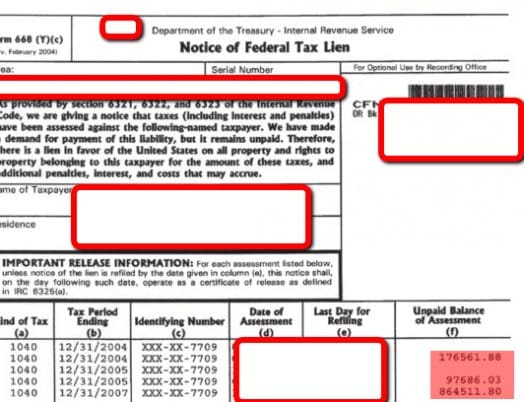

It is a document that is filed and recorded with a county government (usually where the taxpayer lives or does business,) which notifies the general public that a taxpayer has an unpaid IRS tax debt.

How an IRS tax lien affects a taxpayer

Tax liens seem a bit mysterious as to what power they give to the IRS. In legal terms, they “attach” to a taxpayer’s property, which can be either real property (i.e., your house) or personal property (i.e., your car).

If this property is sold while a tax lien is in effect, the IRS will be paid out of the sales proceeds before the taxpayer is paid. So, if these items are never sold, there is no fear of the IRS collecting. However, tax liens are commonly reported to the various credit agencies and can ruin a taxpayer’s credit.

Liens Are Different from IRS collection methods

The IRS generally notifies a taxpayer that a tax lien has been filed by Notice of Federal Tax Lien. Prior to this Notice, the IRS has made threats that a notice will be filed.

A Federal tax lien is a way of protecting the IRS’s ability to collect the tax debt due. In contrast, collection methods or enforced actions are IRS forced collection of the tax debt due. These methods include:

- Wage garnishments/wage levies: continuously confiscating money directly out of a paycheck;

- Bank Levies: confiscation of money directly out of a taxpayer’s bank account.

- Property seizure: seizure of property directly and selling it off to pay the tax debt;

- Federal and state income tax refund levy: confiscating your tax refund before you receive.

How to prevent a tax lien

The best way to prevent a tax lien is to pay off the tax debt when due. If this cannot be done, then setting up an installment agreement may avoid this result. Entering into certain IRS installment agreements will avoid the filing of a tax lien.

If you are able to bring your balance (includes combined tax, penalties and interest) down below $25,000 and set up an installment agreement, called a Streamlined Agreement, generally no federal tax lien will be filed.

To do this, you can always liquidate bank accounts and other assets, or get a loan provided the costs are lower than the costs of the IRS tax debt. Also, in order to get into a payment plan, the IRS requires a taxpayer to be compliant. This means all required tax returns must be filed and all estimated tax payments must be current, if applicable.

How to remove a tax lien

Once a federal tax lien has been filed against a taxpayer, it is much harder to remove. A federal tax lien may be removed by lien withdrawal or lien release.

Tax lien release. Releasing a federal lien means that the lien no longer encumbers your property. Upon releasing a lien, county records will be updated to reflect that the lien has been released. However, the fact that there was once a federal tax lien will remain on your credit report for up to ten years.

Most federal tax liens are automatically released by the IRS after the tax debt is paid in full, generally after 30 days. Be sure to get a copy of the lien release from the IRS to forward to the credit reporting bureaus to update all credit reports.

Tax lien withdrawal. Withdrawing a federal tax lien means the IRS will revoke the lien, as if the lien was never filed. It used to be that withdrawals only occurred when the federal tax lien was filed in error (for example, if it was filed against the wrong person). Now, a taxpayer can get a release and then request a withdrawal after the release to lessen the effects of the tax lien.

The IRS will withdraw or release a tax lien if:

- it was filed in error;

- the entire balance is paid off;

- the outstanding balance is satisfied through an offer in compromise or settlement of the tax debt due;

- a taxpayer brings the tax debt balance under $25,000, sets up a streamlined installment agreement and makes three consecutive direct debit payments; or

- the lien becomes unenforceable. An example of this is when the ten-year collection statute has expired.

Taxpayers needing assistance in dealing with tax liens and IRS collections should seek the advice of a tax attorney. The San Diego Tax Attorneys at Delia Law have many years of tax resolution experience and will competently represent you before the IRS. Please call for a no-cost tax attorney consultation for tax resolution at (619) 639-3336. We look forward to helping you.

This blog post is not intended as legal advice and should be considered general information only.

Keywords: IRS tax lien, federal tax lien, tax lien, IRS tax levy, IRS tax debt

[/column]