[column width=”1/1″ last=”true” title=”” title_type=”single” animation=”none” implicit=”true”]

5 Things a Tax Attorney Would Do Right Now for the Best Tax Year – TAX PREPARATIONS 2017

Tax season is finally over (unless you have an extension) and you can relax with a sigh of relief. This is a good time to reflect back and change some things in order to make next year’s tax time a bit less stressful.

Tax season is finally over (unless you have an extension) and you can relax with a sigh of relief. This is a good time to reflect back and change some things in order to make next year’s tax time a bit less stressful.

Organizing your tax priorities is key. Adopting some of the following tax tips will make the 2018 tax season much less painful and much more lucrative.

-

Track and organize your business expenses

If you run a small business, such as a sole proprietorship, limited liability company or S-Corp, you will have certain business expenses necessary to forming and operating your business. All business expenses taken on a Schedule C must have substantiation, especially in case of a tax audit.

Be sure to save every receipt and file it away in its business expense category. The most convenient way of doing this is to have receipts emailed to you and then forward each email receipt into a certain file folder. You may also save receipts in PDF form and then file them away. Make sure to back everything up to the cloud or other means of backup.

-

Will you itemize?

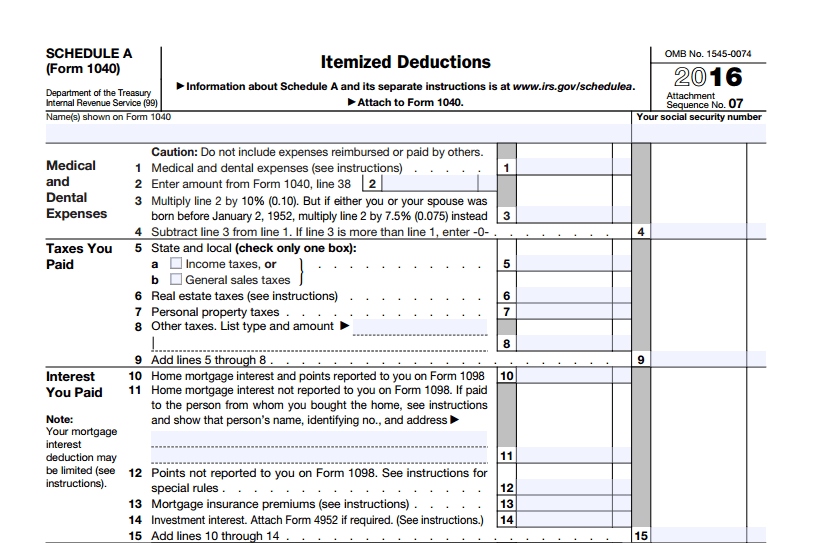

Individual filers may take the standard deduction ($6,300 for a 2017 single filer) or they may itemize their deductions. Obviously, if you plan to have more than $6,300 in itemized deductions, then you should start planning early to itemize.

Planning ahead will help you by knowing what to save and how to keep track of the expenses to be deducted. However, not every dollar spent is deductible. If you decide to itemize, there will be much documentation to organize.

Some of the most common itemized tax deductions include, but are not limited to medical and dental expenses, mortgage interest deductions, interest expense, health insurance if you are self-employed, charitable contributions, state and local taxes, foreign taxes, mortgage points, and losses related to natural disasters. Be sure to work with your tax attorney or tax professional as to your plans on itemizing.

-

Retrieve all financial documents

Instead of waiting till tax time, start organizing early. There are many financial documents that you receive all year long so just file them away when you receive. It is best to receive them in email form so you can shift them into your tax folders. These documents include credit card e-statements, bank e-statements, credit card e-statements, retirement account information, and any business expenses as discussed above.

-

Log all charitable donations and professional dues

Many taxpayers forget to save donation receipts. If you have substantial charitable donations, it is crucial to save all receipts and organize them. Additionally, there are many large charitable donation groups that email you receipts at the end of the year. This donation notification may also include the tax-deductible portion of your donation. Be sure to follow up with them if you have not received timely proper documentation.

Likewise, there are many professional dues taxpayers may overlook. You may be able to deduct dues paid to professional organizations if membership is necessary to perform your job. Dues paid to boards of trade, business leagues, civic or public service organizations, real estate boards, bar associations, medical associations or other trade associations may qualify for a deduction.

-

Be aware of the tax due dates

Obviously, everyone knows that April is tax time, but many do not know there are other very important tax dates for IRS tax preparations. For example, if you are self-employed or receive a 1099, you generally must pay quarterly estimated taxes. These are due the 15th of April, June, September and January. Also, make note in your calendar that your w-2’s and any 1099’s are due by January 31st. You can find many other important tax due dates for the remainder of 2017 at https://deliataxattorneys.com/irs-tax-filing-deadlines-2016/.

If you are missing documentation in preparation of your 2017 tax return, be sure to quickly contact your employer, past employers, IRA program manager, or companies you worked for on a 1099 basis. Don’t wait till April to obtain your documentation, especially if there are any corrections to be made.

The San Diego Tax Attorneys at Delia Law have many years of tax preparation and tax resolution experience and will competently represent you before the IRS. Please call for a no-cost tax attorney consultation at (619) 639-3336. We look forward to helping you.

This blog post on IRS Tax preparations is not intended as legal advice and should be considered general information only.

[/column]